Business Features up for sale: Trick Insights for Savvy Capitalists

In the existing landscape of business realty, discerning capitalists have to browse an intricate variety of market dynamics and appraisal techniques to recognize rewarding chances (commercial sales listings melbourne). Recognizing market patterns, such as pricing variations and occupancy rates, is crucial for making informed decisions. Additionally, effective place analysis and threat evaluation can substantially influence financial investment outcomes. As we check out the multifaceted strategies to examining commercial properties available, one question continues to be: what certain methods can raise your investment game in this competitive sector?

Recognizing Market Fads

Understanding market trends is necessary for making informed decisions in the commercial real estate industry. Investors should examine different signs, including prices patterns, demand and supply dynamics, and economic conditions, to evaluate the market landscape efficiently.

Secret metrics such as occupancy rates, rental yields, and transaction volumes provide crucial insights into market health and wellness. As an example, an increasing tenancy price may indicate an enhancing need for industrial areas, motivating investors to take into consideration critical purchases. Alternatively, declining rental yields could show oversupply or economic declines, necessitating caution in investment strategies.

In addition, macroeconomic aspects such as rate of interest, inflation, and work prices substantially impact business property efficiency. A robust economic situation usually fosters service expansion, causing greater demand for business areas. On the various other hand, economic stagnations can decrease need, affecting building values and rental income.

Staying abreast of neighborhood and national market trends permits investors to profit from opportunities and alleviate threats. Utilizing detailed market evaluations and reports can improve decision-making procedures, making it possible for investors to straighten their approaches with prevailing market problems. Inevitably, comprehending market patterns is crucial for accomplishing success in the competitive field of commercial real estate.

Area Evaluation Techniques

Efficient location analysis techniques are critical for identifying the ideal websites for commercial properties. Investors should assess different elements that affect the worth and performance of an area. One primary strategy is making use of Geographic Info Equipment (GIS), which allows for the visualization and evaluation of spatial information, helping financiers recognize trends and patterns connected to demographics, website traffic flow, and distance to rivals.

Another crucial method is website sees, which enable capitalists to experience the area firsthand, assessing aspects that might not appear in information alone, such as community characteristics and availability. By employing these methods, investors can make enlightened decisions that line up with their financial investment methods, inevitably enhancing their possibilities for success in the competitive business actual estate market.

Assessing Property Value

After carrying out a comprehensive place evaluation, the following action is to evaluate the building worth, which is a fundamental aspect of making educated financial investment choices. Residential or commercial property assessment incorporates various approaches that give understanding into the possession's worth and possible roi.

The three key strategies to home valuation include the price strategy, the sales comparison technique, and the revenue method. The price method approximates the worth based on the find more cost to reproduce the residential property, minus depreciation. This approach is particularly useful for new building and constructions or distinct buildings lacking comparables.

The sales comparison approach entails assessing current sales of comparable residential properties in the location. This technique requires a thorough understanding of the neighborhood market and can be affected by market trends, need, and supply characteristics.

Lastly, the income method is vital for investor-focused residential or commercial properties, as it evaluates potential revenue generation with rental yields. This approach thinks about web operating income and capitalization prices, offering a clear photo of financial stability.

Involving an expert appraiser can improve the precision of these analyses, making sure that financiers choose based upon trusted data and market truths.

Assessing Financial Investment Dangers

Financial investment threats in commercial home purchases can considerably influence prospective returns and total financial stability. Capitalists must perform complete due diligence to determine and alleviate these dangers successfully. Key considerations include market variations, occupant dependability, and property-specific issues.

Market threats, consisting of economic declines and adjustments in neighborhood demand, can impact property values and rental revenue. Comprehending the economic signs and patterns in the location can assist capitalists prepare for potential decreases.

Property-specific risks, such as upkeep issues or zoning changes, can additionally position difficulties. A comprehensive evaluation and an understanding of neighborhood policies can reveal potential liabilities that might not be right away evident. Furthermore, ecological dangers, such as contamination or all-natural disasters, need to be reviewed, as they can lead to significant economic problems.

Funding Alternatives Offered

Navigating the landscape of funding alternatives is vital for financiers seeking to acquire industrial residential properties. Recognizing the different financing avenues available can significantly influence investment returns and total success.

For those seeking a lot more flexible terms, private loan providers or difficult cash lendings can be a practical option. These sources typically cater to capitalists who might not meet traditional demands, though they include higher rates of interest and much shorter payment periods. Furthermore, government-backed finances, such as those supplied by the Small company Management (SBA), can supply reduced down repayment alternatives and desirable terms for qualifying services.

Eventually, financiers must evaluate their financial scenarios, threat resistance, and long-lasting goals to choose the most ideal financing option for their business home investments. Careful factor to consider will ensure that they optimize their potential for productivity and success.

Final Thought

In conclusion, effective financial investment in business properties demands a comprehensive understanding of market fads, efficient location analysis, and exact building appraisal. By methodically evaluating financial investment dangers and discovering diverse funding choices, capitalists can boost decision-making processes and improve prospective returns. A strategic technique, based in complete study and analysis, eventually increases the probability of accomplishing beneficial end results within the affordable landscape of commercial property.

In the existing landscape of commercial real estate, discerning capitalists must navigate an intricate array of market dynamics and assessment strategies to identify rewarding possibilities. An increasing tenancy rate may indicate a raising demand for industrial areas, motivating investors to think about calculated procurements.Staying abreast of local and nationwide market fads permits financiers to exploit on opportunities and reduce threats. Making use of extensive market evaluations and records can boost decision-making processes, enabling investors to straighten their techniques with dominating try this website market problems. By systematically evaluating investment dangers and exploring diverse financing alternatives, capitalists can boost decision-making procedures and enhance prospective returns.

Daniel Stern Then & Now!

Daniel Stern Then & Now! Joshua Jackson Then & Now!

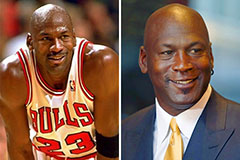

Joshua Jackson Then & Now! Michael Jordan Then & Now!

Michael Jordan Then & Now! Talia Balsam Then & Now!

Talia Balsam Then & Now! Traci Lords Then & Now!

Traci Lords Then & Now!